Agentic AI: The New Frontier of Business Transformation

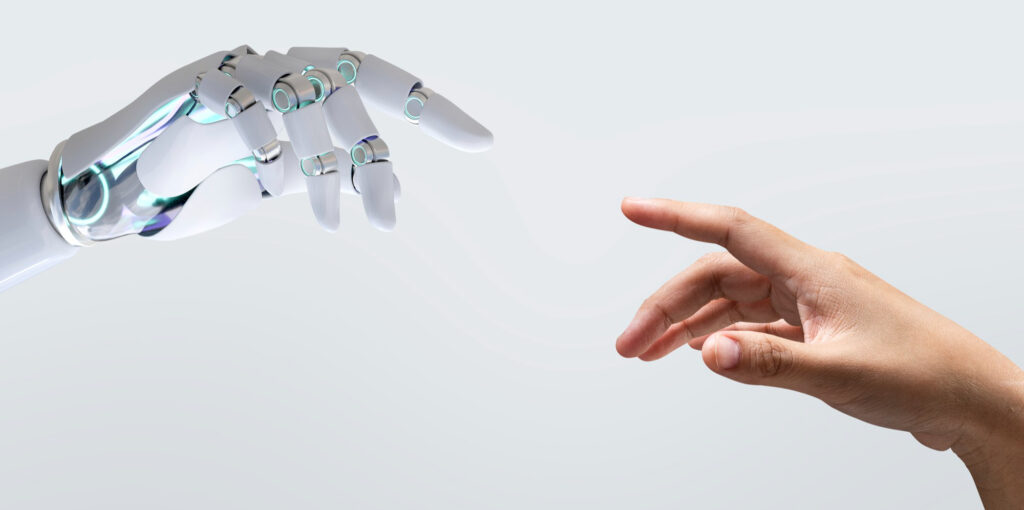

Artificial Intelligence is entering a new phase, moving beyond repetitive task automation and data analysis to evolve into models capable of operating with greater autonomy

Artificial Intelligence is entering a new phase, moving beyond repetitive task automation and data analysis to evolve into models capable of operating with greater autonomy

An organisation’s population is the key to achieving objectives and obtaining results. This makes the recruitment process critical, so as to attract the right resources, at the right time and, most importantly, to the right roles. To be effective, this process should be flexible and permeable to market trends and to the motivations that drive new generations to choose a company as their employer. Such motivations are increasingly less linked to economic factors and more so to the vision the organisation is able to express.

Artificial Intelligence (AI) and Machine Learning (ML) have gained significant attention due to their disruptive potential across industries. In the context of software testing, AI/ML

Artificial Intelligence (AI) is revolutionizing customer service in the banking industry and transforming how companies operate and interact with their customers, especially within the banking sector. AI-powered solutions allow companies to deliver personalized, efficient, and accurate service to their customers, ultimately leading to higher levels of customer satisfaction and loyalty. Through the use of chatbots, machine-learning algorithms, voice recognition technologies, and other advanced AI technologies, companies are enhancing their customer service capabilities in ways that were once unimaginable.

Despite the ongoing economic impact of the pandemic and the consequent impact on many company’s budgets, cybersecurity budgets continue to grow. While the increase in

Computing delivers software applications, data storage, and increasingly on-demand transaction processing from data centers, via the Internet or the cloud.

In the fast-paced world of modern banking, payment technology has undergone a revolution, transforming the way people conduct transactions. Gone are the days of solely relying on physical cash or checks; today’s banking landscape is dominated by digital payment solutions that offer convenience, security, and efficiency.

Main office:

New York

122 East 42nd St. Suite 4705

New York, NY 10168

Hubs in:

Boston, MA

Chicago, IL

Raleigh, NC

Houston, TX

Miami, FL

San Francisco, CA